I have closed my tax file in Malaysia when I relocated to. 4 EASY STEPS TO FILING.

Changed Jobs Here S How You File Your Tax Returns

File your income tax online via e-Filing 4.

. Not filing your taxes. The following instructions and screenshots are based on the latest version of. Both residents and non-residents are taxed on income accruing in or derived from Malaysia.

Heres how you can file your income tax with the e-filing system. Check your basic information and make sure the displayed details are. Thats a lot of money people.

For example if your total. Jacks Income Tax Payments RM 100000 x 28 RM 28000. Hence the amount of total.

Under section 270A under-reporting of income can attract a penalty of up to 50 of the tax. The deadline for filing income tax in Malaysia is 30 April. If you earn enough to be taxed as of 2015 this means earning an annual income of RM34000.

Malaysia has implementing territorial tax system. Click on e-filing then choose e-Application for Amended BE. Information on Taxes in Malaysia.

Missing this deadline can mean a penalty starting at 10 and up to 300 of the tax payable upon failure of submitting the income tax return form. If you forget to file them. The Inland Revenue Board of Malaysia LHDN website for filing income tax has been revamped.

31032022 30042022 for e-filing 4. Long answer - If caught by the LHDNs auditor youll face a penalty ranging from 80 to 300 of the taxable amount. Ensure you have your latest EA form with you 3.

Verify your PCBMTD amount 5. Common tax offences that could get you into trouble. First is to determine if you are eligible as a taxpayer 2.

If you are not a tax resident you would not enjoy income tax reliefs. The rate of penalty. Make an incorrect tax return by omitting or understating any income.

According to the Inland Revenue Board Of Malaysia LHDN failing to pay your taxes on time will incur a 10 increment on your payable tax. The deadline for filing income tax in Malaysia is 30 April 2019 for manual filing and 15 May 2019 via e-Filing. However this might attract the tax enquiry but dont worry if you have not done anything wrong.

Log in to the IRBs e-filing as follow. Go to the LHDN e-filing website and log in. 1131a Give any incorrect information in matters affecting the tax liability of a taxpayer or any other person.

The format for supporting. Failure to pay self-assessment tax prior to the filing of return.

How To Re Submit Your Income Tax Form If You Did It Wrong Malaysia Financial Blogger Ideas For Financial Freedom

All About Tax Audit Under Section 44ab Of Income Tax Act Ebizfiling

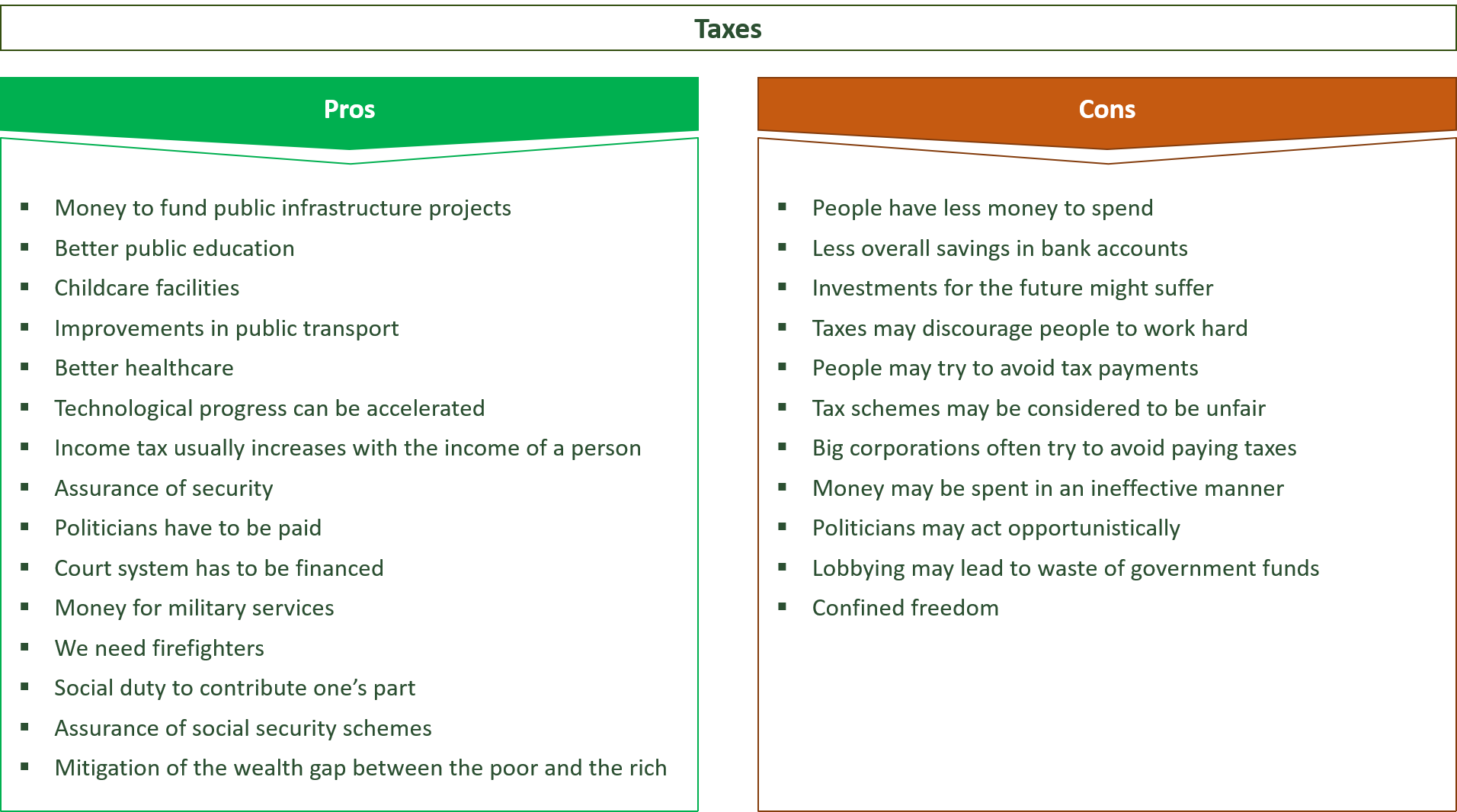

29 Crucial Pros Cons Of Taxes E C

3 21 3 Individual Income Tax Returns Internal Revenue Service

/u-s-tax-filing-1090495926-21c69e6cc0ba4db0894841c99b26adbf.jpg)

Notice Of Deficiency Definition

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Newsletter 39 2019 Income Tax Exemption No 8 Order 2019 Page 001 Jpg

Made A Mistake On Your Tax Return 15 Things You Need To Know

3 21 3 Individual Income Tax Returns Internal Revenue Service

Newsletter 27 2019 Faq Voluntary Disclosure Program Page 002 Jpg

Seeing Number Of Gst Notices To Collect Outstanding Gst Directly From Bank Accounts Applies To Ecomm Operators Accounting Tax Services Accounting Software

Martha S Income Tax Notary Public Home Facebook

3 21 3 Individual Income Tax Returns Internal Revenue Service

How Much Of Federal Withholding Do I Get Back